|

|

|||

|

||||

| Web Sites, Documents and Articles >> Hartford Courant News Articles > | ||

|

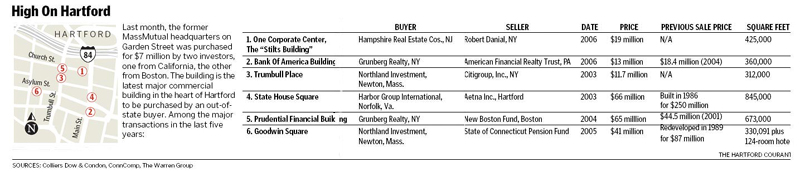

Seizing Opportunities In City Out-Of-State Investors Drawn To Hartford Office Properties June 20, 2006 As cities go, Hartford is a small place: Walk three blocks in any direction and you'll bump into the edge of the central business district. But these days, downtown Hartford office properties are attracting big attention from investors and developers from outside the state - so much so that only one major building - the Gold Building on Main Street - remains locally owned. Experts and economists say the prospect of the city's long-awaited rebound is certainly part of the reason for drawing interest from far beyond the city's - and the state's - borders. But there is another, even stronger one: prices and cash to spend. And even though sales prices in Hartford have risen significantly in recent years, they are still nowhere near Boston or New York. "There are a dozen buyers in the market today that couldn't pronounce Hartford six years ago," said William Fenn, a top executive in Hartford at New Boston Fund, a Boston-based firm that was among the first out-of-state firms in the mid-1990s to begin investing in the city and the surrounding suburbs. In a city wary of far-flung corporate ownership, commercial real estate experts and economists say interest from out-of-state real estate investors and buyers is a healthy phenomenon, bringing new sources of private capital into a city sorely in need of it. But outside ownership also can mean that at least some slice of rental income will not remain in the city, said Jeffrey Blodgett, vice president of research at the Connecticut Economic Resource Center. "On balance, though, there is probably more on the plus side," Blodgett said. For years, many of the city's signature buildings were built and operated by local owners, but that began changing in the late 1990s. For instance, One Corporate Center - the "Stilts Building"- has had two out-of-state owners since 2002 after a long ownership by Hartford-based Chase Enterprises. Already this year, there have been three high-profile sales in and around downtown Hartford. Last month, the former MassMutual headquarters on Garden Street sold for $7 million, purchased by investors from California and Massachusetts. That followed closely on the purchase of the "Stilts Building" by a New Jersey investor group, which paid $19 million. And in late March, the Bank of America building was purchased by a Manhattan-based real estate firm for $13 million. The price paid for the Stilts Building represents about $49 a square foot. That price is about $13 a square foot more than the $36 a square foot that was paid for the comparable Bank of America building. While the city may still suffer cutbacks as a result of corporate mergers, the levels of outside investment conveys a sense that the worst may be behind Hartford, experts said. The city has seen its base of financial services and insurance jobs erode over the last decade. "The hope is that companies here will start to grow," said Jay Wamester, a broker at Colliers Dow & Condon in Hartford. Many believe Hartford's best chances for expansion rest with the companies that are already in and around the city. The city hasn't, at least so far, enticed a big company to move into downtown. In recent years, leasing has remained sluggish in the city, in contrast to more robust growth in the surrounding suburbs. Even so, the downtown area is still considered fairly stable, without wide swings up or down in vacancies, that larger cities such as Boston or New York have experienced, said Whit Osgood of Osgood & Associates, a commercial brokerage firm in South Glastonbury. And the state's investment of tens of millions in residential and convention center projects in downtown Hartford is attractive to would-be investors. That's part of the reason why a group of real estate investors from California and Massachusetts last month bought the former MassMutual complex on Garden Street, just beyond the downtown area. The buyers, Hackman Capital Partners LLC in Los Angeles and Calare Properties Inc. of Hudson, Mass. paid $7 million for building with the stately Georgian Revival facade. The investors are now deciding what to do with the sprawling, 450,000-square-foot complex, though experts say the obvious first choice is office. Some recent buyers from outside the state say they may see more potential in the city because they are less jaded than natives, who have suffered a series of disappointments as the city has attempted to remake itself. Harbor Group International in Norfolk, Va., which purchased State House Square for $66 million in 2003, said it has routinely targeted marquee assets in smaller cities for its investment portfolio. David Starowicz, the group's vice president, said it has been pleased with its investment and has no current plans to sell the office complex, one of the largest in downtown Hartford. Despite lower prices in Hartford, buyers do well to have some plan in mind for what they will do with a building before they close the deal. "You've got to be careful," Starowicz said. "You can't just go in and hope the market will rise."

|

||

| Last update:

September 25, 2012 |

|

||

|