|

|

|||

|

||||

| Web Sites, Documents and Articles >> Hartford Courant News Articles > | ||

|

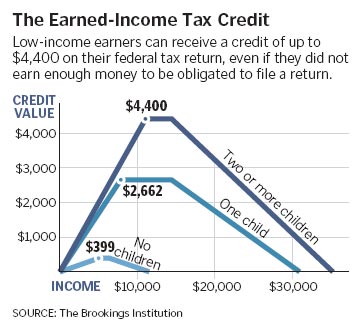

A Lift For Low-Wage Workers Tax Credit Provides Cash To Pay Bills, Buy Necessities February 14, 2006 While bankers on Wall Street bask in the glow of a $21.5 billion bonus season, another bonus ritual is playing out for tens of thousands of low-wage Connecticut workers this month. It's the earned income tax credit, a federal program designed to reward work by offering low-income earners a credit of up to $4,400 on their federal tax return. About 170,000 tax filers in Connecticut last year received more than $260 million - an average payday of slightly more than $1,500 each.

It may be a pittance by Wall Street standards, but for the households who use the "refund" each year to help pay down bills, buy clothes for the kids or get ahead for once on the monthly rent, the EITC can be a lifeline. "Every little bit extra I can get, it definitely helps," said Ana Rodriguez, 35, a single mother of two who made just under $25,000 last year as a medical claims adjuster. Rodriguez, who lives in East Hartford, rattles off a list of items that she will spend her $2,251 credit on this year: credit card bills that have gotten out of hand, college application fees for her 17-year-old son, and airfare to Florida so he can actually attend his top choice school if he's accepted. For Angel and Omayra Fernandez, a married couple with three boys who together made a little over $30,000 last year, mid-February is a time of year they eagerly anticipate. This year the anticipation was heightened because Omayra discovered a community center where volunteer preparers would do the couple's taxes for free, allowing her to save the $269 she spent last year for a commercial preparer. "When we get the refund, it goes to the necessary stuff," said Angel Fernandez, who pulled in around $19,000 last year as a lawn care specialist. "Whatever the kids need, that comes first. Then, after that, we plan a vacation." This year's plans? "Orlando!" husband and wife say in unison. The last time the family took a trip was Feb. 19, 2004 - paid for in part by the prior year's tax credit. They piled their kids and Angel's mother into a rental car, had a ball driving around Florida, and vowed to return as soon as they could. To the academics who research the influence of the federal EITC, which is now entering its fourth decade, stories such as those told by Rodriguez and the Fernandez family - both at the higher end of the low-income families the credit serves - sound familiar. "So many working people look forward to this time of year to get their tax return so they can buy things they've been putting off for a long time," said Timothy Black, the director of the Center for Social Research at the University of Harford. As for using the money for a family vacation, researchers say it's a sign the program is working as intended. "In some ways it's an attempt to emulate middle class patterns, especially going to Orlando, which is giving their children a middle class vacation," Black said. Across the nation, about 21 million people claimed the credit last year, pulling in $39 billion, according to the IRS. Although only about 75 percent of eligible filers claimed their due, the federal program - which was created in 1975 under President Ford and later expanded under Presidents Reagan and Clinton - has eclipsed welfare as the main source of cash assistance for low-income families. The cutoff for the credit varies. For families with at least two children, the income limit is around $36,000. The EITC is above and beyond any amount the families get from the child tax credit, which is a maximum of $1,000 per child and is aimed mainly at middle income households. For single parents in Connecticut supporting at least two kids on minimum wage, the EITC means a boost in last year's $7.10 hourly wage to about $9.16. But people without children rarely benefit from the program. Chester Hynes, 21, a part-time clerk at Stop & Shop in West Hartford, had been counting on the credit to buy insurance for his car. When he found out last week that he didn't qualify, he did some quick calculations. "I think I'll have a kid this year," he said after the initial shocked silence. "Don't you get a credit when you have a kid?" "Yes, but a kid costs a fortune,"

shot back the volunteer who was filing his forms. "And they'll

cost you for 20 years." Two years ago she purchased a car with her credit of approximately $2,600. Before she bought the car, the commute from her home in East Hartford to her job in Wethersfield took about an hour and a half by bus and required complex coordination with her baby sitter. Now the trip takes 15 minutes. Researchers point to people like Paula as evidence that the program goes beyond helping families make ends meet on a day-to-day basis by also helping them get ahead. "We don't have good empirical evidence that shows how receipt of the EITC contributes to your long-term social and economic mobility. But it's not too hard to make the argument that the existence of the EITC is what got a lot of people in the labor market to begin with, and it's what keeps people in," said Alan Berube, a fellow at the Brookings Institution. "Getting in the labor market and staying in, those are the keys to getting out of poverty over the longer term." Across the country, 18 states - although not Connecticut - have offered their own earned income credit, often based on a percentage of the amount received at the federal level. The 18 state programs not only give more money to those who need it, say advocates for the working poor, but they also provide exposure for the federal program. The lack of visibility is one of the major complaints advocates have about the EITC - too many eligible residents simply fail to claim their credit. The IRS estimates that about 25 percent of low-wage workers leave their credit unclaimed, either because they make so little that they don't bother filing taxes, or because they simply don't know to complete the extra form. In Connecticut, that means between $65 million and $100 million is left unspoken for - about 10 percent of that amount in Hartford alone. Another concern among advocates is that the working poor often pay money they can little afford to have their taxes done - and usurious interest rates for immediate refunds. Research from the Brookings Institution estimates that more than 11,500 Hartford residents shelled out an average of $160 each, or a total of $1.8 million, to commercial preparers in 2003. Many of them could have had their taxes done for free at local centers manned by volunteers who have been trained by the IRS through the agency's Volunteer Income Tax Assistance Program. Volunteers at the free tax centers pay extra attention to the EITC. The eligibility requirements are simple, but the forms can be complicated. That's one of the reasons that David McGhee, the site coordinator of the Village for Families & Children volunteer tax center on Wethersfield Ave., spends at least an hour each night after everyone else has left reviewing each tax return before filing it with the IRS. Sometimes, he says, people trip themselves up on one of the very first questions: "If the child is not married, check Yes." "Well, a lot of people check `No.' They think, `My kid's not married.' If you answer that question wrong, your EITC is gone," McGhee said. Without the extra money, Paula - the Ocean State worker who takes care of her 14-year-old brother along with her 3-year-old son - says she wouldn't know what to do. This year, she plans to spend her credit on a computer. "Most of the stuff I do at work, I need to learn a computer for. And my brother needs to do work on a computer for school. It takes me too much time to take him to the library," she said. For information on local Volunteer Income Tax Assistance centers, contact Co-opportunity Partners Inc. at 860-236-3617, Ext. 123.

|

||

| Last update:

September 25, 2012 |

|

||

|